Auto Insurance in and around South Bend

Looking for great auto insurance in South Bend?

All roads lead to State Farm

Would you like to create a personalized auto quote?

You've Got A Busy Schedule. Let Us Help!

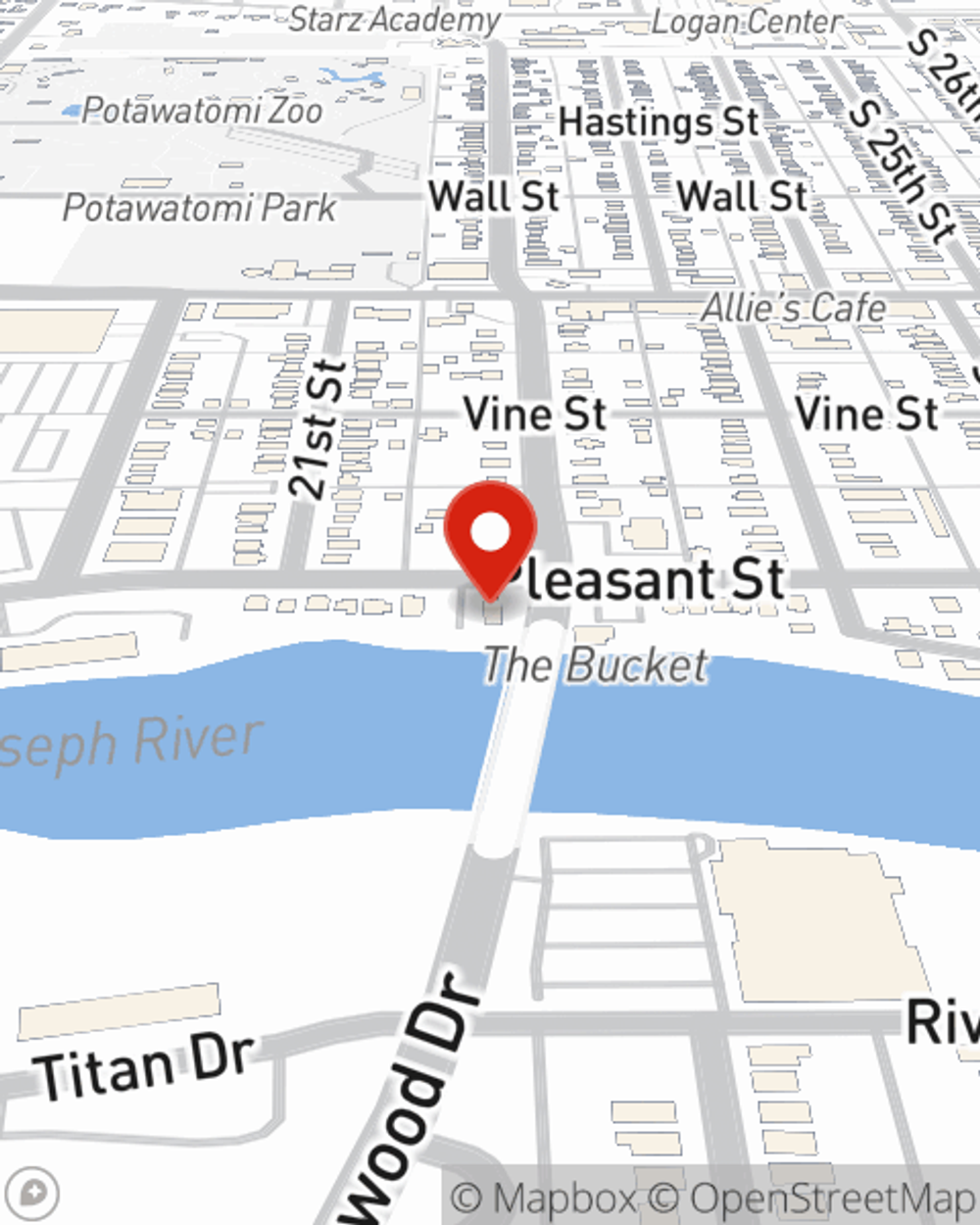

Why choose Steve Wilson to insure your vehicle? You need an agent who is not only knowledgable in the field, but is also your personal representative. With State Farm, South Bend drivers can enjoy a protection plan aligned with their unique needs, all backed by the leading provider of auto insurance.

Looking for great auto insurance in South Bend?

All roads lead to State Farm

Auto Coverage Options To Fit Your Needs

State Farm offers flexible reliable coverage with a variety of savings options available. You could sign up for Drive Safe & Save™ for savings up to 30%. Then there's the Steer Clear and Good Student Discounts that offer savings until you turn 25. And Vehicle Safety Features applies if your vehicle has an alarm or some other anti-theft device to deter crime. These are examples of the savings options State Farm offers! Most State Farm customers are eligible for one or more savings option. Steve Wilson can show which ones you qualify for to make a policy for your specific needs.

Do you also need protection for your electric and hybrid car or commercial auto? Would you be interested in emergency road service coverage or teen driver coverage? Or are you simply worried about when trouble finds you on the road? State Farm agent Steve Wilson offers attentive straightforward care to help address your needs. Call or email the office to get started today!

Have More Questions About Auto Insurance?

Call Steve at (574) 255-5200 or visit our FAQ page.

Simple Insights®

Safety tips when riding a motorcycle with a passenger

Safety tips when riding a motorcycle with a passenger

Riding double on a motorcycle requires extra caution. Do your research and know what’s different when it comes to safety when you have a passenger on your bike.

Steve Wilson

State Farm® Insurance AgentSimple Insights®

Safety tips when riding a motorcycle with a passenger

Safety tips when riding a motorcycle with a passenger

Riding double on a motorcycle requires extra caution. Do your research and know what’s different when it comes to safety when you have a passenger on your bike.